How Parents Can Financially Plan a GMAT-Based Study Abroad Journey

- Akanksha Shinde

- 5 days ago

- 4 min read

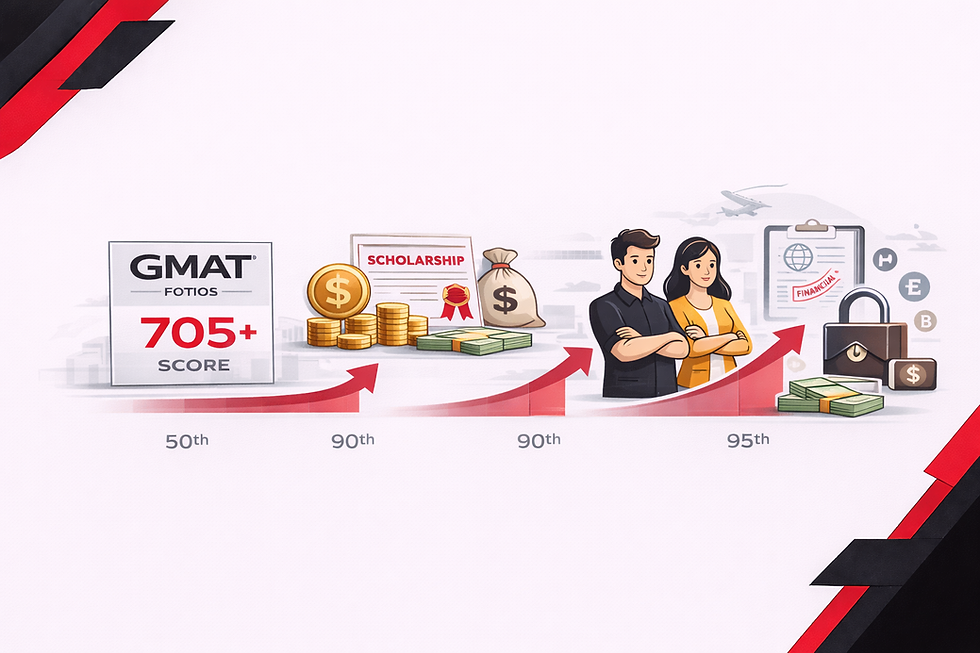

For the parents of engineering graduates in 2026, the aspiration to see their child lead a global tech giant or a major consulting firm often comes with a significant financial question mark. Unlike a standard technical Master's, a GMAT-backed management degree is a high-stakes investment that requires more than just savings—it requires a tactical roadmap. Understanding how parents can financially plan a GMAT-based study abroad journey is the first step in transforming a student's technical potential into global executive success.

In 2026, the "cost of attendance" has evolved beyond simple tuition and airfare; it now encompasses managing currency fluctuations, leveraging "Focus Edition" scores for massive scholarships, and navigating new STEM-designated loan structures. For an engineering family, this journey is not just a cost, but a diversified financial asset that offers a hedge against local economic shifts.

2026 Parent’s Financial Roadmap: Global Management Education

The following table provides a high-level budget and ROI projection for parents planning an international management journey for their engineering child in 2026.

Table: How Parents Can Financially Plan a GMAT-Based Study Abroad Journey (2026 Data)

Financial Phase | Typical Cost Range (USD) | GMAT Score Impact (The "Focus" Lever) | Parent's Strategic Action |

Pre-App Phase | $2,000 – $5,000 | High score reduces # of apps needed | Budget for 2-3 GMAT attempts & prep |

Tuition (Total) | $60,000 – $140,000 | 685+ Score = 50% to 100% Waiver | Target "Early Bird" scholarship cycles |

Living Expenses | $20,000 – $35,000 /yr | N/A (Location dependent) | Use "Blocked Accounts" for EU or local loans |

Misc (Visa/Tech) | $3,500 – $6,500 | N/A | Buffer for health insurance & tech upgrades |

ROI (Break-even) | 1.8 – 3.2 Years | Higher score = Better Tier = Faster ROI | Plan for "Refinancing" post-employment |

1. Leveraging GMAT for Scholarship Safety Nets

The most effective way how parents can financially plan a GMAT-based study abroad journey is to treat the GMAT score as a "Financial Lever". In 2026, business schools are increasingly using GMAT Focus Edition scores to distribute merit-based aid.

The 685 Threshold: For engineers, a score of 685 or higher on the Focus Edition (96th percentile) often triggers automatic merit scholarship consideration. This can reduce the total tuition burden by $40,000 to $80,000.

Diversity and Technical Awards: Many schools in 2026 have specific funds for "Techno-Managerial" talent. A strong GMAT score combined with an engineering background makes your child a prime candidate for these exclusive pots of money.

Early Application Bonus: Scholarships are often "first-come, first-served". Financial planning should involve a GMAT attempt at least 12 months before the intended intake to hit Round 1 deadlines.

2. Diversified Funding: Loans and STEM Designations

In 2026, parents no longer need to liquidate all personal assets to fund an MBA.

STEM-Designated MBA Loans: If your child pursues a STEM MBA (highly recommended for engineers), they are eligible for specialized loans with lower interest rates due to their high projected earning potential in tech strategy.

Collateral-Free International Loans: Companies like Prodigy Finance or MPOWER Finance offer loans based on future earnings rather than the parents' current assets, provided the school is top-ranked.

Blocked Accounts and Living Costs: Especially in Europe (Germany/France), parents must plan for "Blocked Accounts" where a year's living expenses are deposited upfront.

3. Managing Currency Risks and ROI in 2026

A critical part of how parents can financially plan a GMAT-based study abroad journey is accounting for currency volatility.

Staggered Remittance: Instead of sending all funds at once, staggered transfers can help average out currency exchange rates.

The Payback Period: For an engineer, a global management degree typically pays for itself in under 3 years. Parents should view the initial two years of high expenditure as a bridge to a starting salary of $165,000+.

Hedged Investments: Keeping a portion of the education fund in USD or EUR-denominated assets starting 18 months before departure can mitigate "exchange rate shock".

FAQ: How Parents Can Financially Plan a GMAT-Based Study Abroad Journey

1: How parents can financially plan a GMAT-based study abroad journey if they don't have large savings?

A: The strategy should focus on two pillars: a high GMAT score and "Future-Earnings" based loans. A GMAT score above 675 can secure a 50% tuition waiver, making the remaining amount much easier to cover through a collateral-free international loan that the student pays back themselves from their global salary.

2: Is it better to take a loan in the home country or the host country?

A: In 2026, host-country or international lenders often provide better terms for STEM-designated programs because they account for the higher salaries available in global markets. However, parents should compare the "Effective Interest Rate" after considering currency depreciation.

3: What is the most overlooked expense for parents?

A: The "Pre-Departure Buffer"—this includes GMAT retakes, application fees for 5-7 schools, visa processing, and the initial deposit to hold a seat. Budgeting an extra $5,000 for these hidden costs is essential.

Secure Your Child's Global Legacy

Financial preparation is the foundation upon which global careers are built. Start your tactical planning today to ensure that budget constraints never limit your child's potential.

2026 Parent’s Budget Calculator: Get a customized 2-year financial roadmap based on your target country.

GMAT Scholarship Matcher: Discover which schools give the highest financial aid to engineers.

Loan Eligibility Checker: See if your child qualifies for collateral-free international funding.

Comments