CA Articleship Training Structure 2026: New 2-Year Practical Training Rules Explained

- mayuri pawar

- 1 day ago

- 3 min read

The CA Articleship training structure 2026 marks a significant academic reform under the ICAI New Scheme of Education and Training. Designed to align theoretical learning with structured practical exposure, the revised articleship model reduces the duration while strengthening conceptual application across accounting, taxation, audit, and compliance domains.

This CA articleship training guide 2026 explains the course framework, eligibility flow, training duration, stipend structure, leave rules, and discipline guidelines, making it the definitive resource for students planning their CA journey this year.

What Is CA Articleship Training Structure Under ICAI? (2026 Framework)

CA Articleship is a mandatory practical training module embedded within the Chartered Accountancy course structure. Under the ICAI New Scheme, articleship is positioned as the bridge between the CA Intermediate and CA Final levels.

Key Academic Purpose:

Application: Apply CA syllabus concepts in real-world accounting environments.

Procedural Mastery: Develop a deep understanding of taxation, audit, and compliance.

Skill Acquisition: Build discipline, documentation, and reporting skills.

Articleship is not optional and must be completed exactly as prescribed by ICAI to qualify for CA Final examination eligibility.

CA Articleship Training Duration & Eligibility 2026

The most significant update for 2026 is the streamlined timeline. The reduction from three years to two years allows for faster academic progression and better synchronization with the Final syllabus.

Eligibility Milestones

Students can only commence their training after fulfilling these specific academic requirements:

Clearance: Passed both groups of CA Intermediate.

Soft Skills: Completed ICAI ITT (Information Technology Training) and Orientation Course.

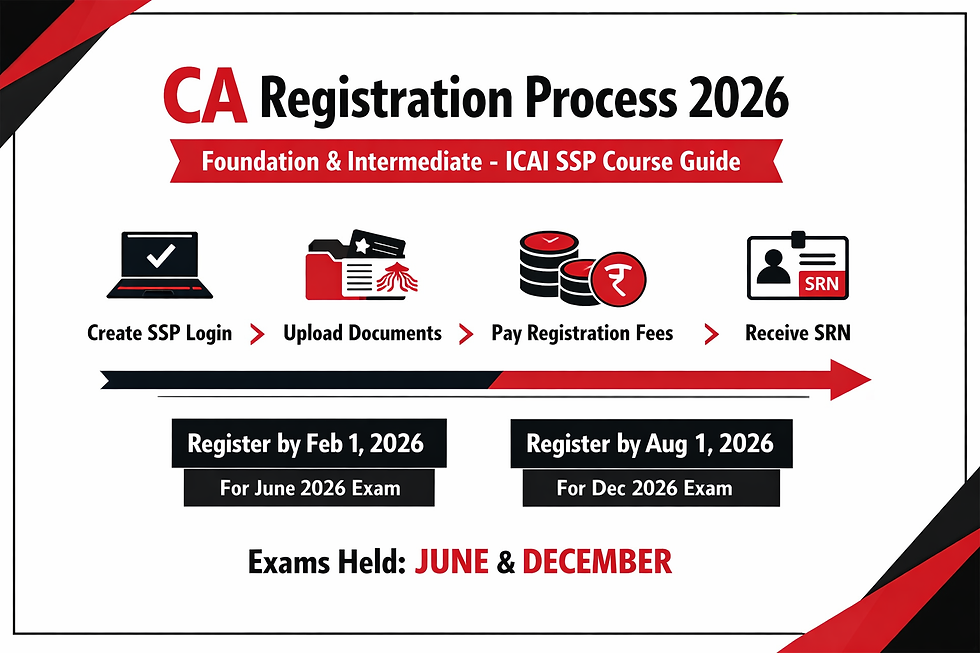

Registration: Formally registered through the ICAI SSP Portal.

Documentation: Executed Form 102 and Form 103 digitally.

Training Overview Table

Feature | Details (2026 New Scheme) |

Total Duration | 2 Years (24 Months) |

Applicability | Students appearing for Intermediate/Final in 2026 |

Prerequisite | Clearing Both Groups of Intermediate |

Mandatory Training | ICITSS (ITT & Orientation) |

Subject-Wise Exposure: The Training Framework

During the 24-month period, students gain supervised exposure to core academic areas that directly mirror the CA Final curriculum.

Accounting & Financial Reporting: Preparation of financial statements under Ind AS.

Direct Taxation: Income Tax filing, TDS compliance, and representation.

Indirect Taxation: GST returns, reconciliations, and audit compliance.

Statutory & Tax Audit: Verification of books and internal control testing.

Corporate Law: ROC filings and secretarial compliance.

ICAI Stipend Structure for Articleship 2026

To support students during their academic training, ICAI prescribes minimum monthly stipend slabs. While firms may pay more, they cannot legally pay less than these mandates.

Minimum Monthly Stipend (2026 Mandate)

Training Period | Minimum Stipend (Monthly) |

First Year | ₹2,000 – ₹3,000 |

Second Year | ₹3,000 – ₹4,000 |

Leave Rules and Discipline (Academic Compliance)

To maintain training rigor, ICAI has strict regulations regarding absences. This ensures that the reduction in duration does not lead to a reduction in learning quality.

Leave Entitlement 2026:

Annual Allowance: 24 days per year.

Total Period: Maximum 48 days across the 2-year duration.

Consequence: Any excess leave taken will result in a pro-rata extension of the articleship end date.

Training Discipline:

Daily Hours: Minimum 7 hours per day.

Weekly Requirement: 35–40 hours.

Supervision: Must be under a full-time practicing Chartered Accountant (Principal).

Transfer and Termination Rules

ICAI permits the transfer of articleship only under specific academic or personal conditions to ensure stability in training.

First Year: Transfer is permitted without assigning a specific reason.

Second Year: Permitted only under "exceptional grounds" such as medical issues, relocation of the student/principal, or mutual consent.

FAQs: CA Articleship Training Guide 2026

Q1. What is the CA articleship training guide 2026?

It is the updated framework detailing the 2-year practical training rules, stipend, and eligibility under the ICAI New Scheme.

Q2. Is CA articleship compulsory in 2026?

Yes, it is a mandatory academic component that must be completed before appearing for the CA Final exams.

Q3. Can I start articleship after passing only one group of Intermediate?

No. Under the 2026 rules, you must pass both groups of CA Intermediate to be eligible.

Q4. How many leaves can I take during the 2 years?

You are allowed a total of 48 days of leave over the two-year period.

Final Thoughts

The CA Articleship training structure 2026 reflects a modern, streamlined approach to professional education. By reducing the duration but tightening the eligibility and leave rules, ICAI ensures that future CAs are both technically proficient and ready for the demands of the global financial market.

Comments